The 8-Second Trick For Clark Wealth Partners

The Single Strategy To Use For Clark Wealth Partners

Table of ContentsThe Best Strategy To Use For Clark Wealth PartnersClark Wealth Partners Can Be Fun For EveryoneThe 9-Minute Rule for Clark Wealth PartnersAll About Clark Wealth PartnersClark Wealth Partners for BeginnersFacts About Clark Wealth Partners UncoveredThe Facts About Clark Wealth Partners Uncovered

The world of money is a difficult one., for instance, recently found that almost two-thirds of Americans were incapable to pass a basic, five-question monetary proficiency examination that quizzed participants on topics such as rate of interest, financial debt, and various other reasonably fundamental principles.Along with managing their existing clients, economic experts will typically invest a fair quantity of time every week meeting with possible customers and marketing their solutions to preserve and grow their service. For those considering becoming a monetary advisor, it is essential to consider the typical income and work security for those operating in the area.

Training courses in tax obligations, estate planning, investments, and danger monitoring can be handy for pupils on this course. Depending upon your distinct occupation objectives, you might additionally require to make particular licenses to accomplish certain clients' requirements, such as dealing stocks, bonds, and insurance coverage. It can likewise be practical to earn an accreditation such as a Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Expert (PFS).

The Ultimate Guide To Clark Wealth Partners

What that looks like can be a number of things, and can vary depending on your age and stage of life. Some individuals fret that they need a certain quantity of money to spend before they can get help from a professional (financial planner in ofallon illinois).

Some Known Questions About Clark Wealth Partners.

If you have not had any kind of experience with an economic advisor, below's what to expect: They'll begin by offering a comprehensive evaluation of where you stand with your possessions, responsibilities and whether you're meeting benchmarks compared to your peers for cost savings and retired life. They'll evaluate brief- and long-term objectives. What's valuable about this step is that it is customized for you.

You're young and functioning full-time, have a cars and truck or two and there are trainee lendings to repay. Below are some possible concepts to aid: Establish excellent savings routines, repay financial obligation, set baseline objectives. Repay student loans. Relying on your profession, you might qualify to have part of your college lending waived.

Clark Wealth Partners Can Be Fun For Everyone

Then you can talk about the following finest time for follow-up. Prior to you begin, ask about prices. Financial advisors typically have different rates of prices. Some have minimal asset degrees and will certainly charge a fee commonly several thousand dollars for creating and changing a strategy, or they might charge a level cost.

You're looking in advance to your retired life and aiding your kids with higher education and learning expenses. An economic consultant can use recommendations for those scenarios and even more.

Clark Wealth Partners - The Facts

Arrange normal check-ins with your coordinator to modify your strategy as required. Stabilizing financial savings for retirement and university prices for your youngsters can be complicated.

Considering when you can retire and what post-retirement years may appear like can generate issues regarding whether your retirement cost savings remain in line with your post-work plans, or if you have conserved sufficient to leave a legacy. Aid your economic specialist comprehend more your method to money. If you are a lot more conservative with saving (and potential loss), their recommendations must react to your fears and worries.

The 6-Second Trick For Clark Wealth Partners

Planning for health and wellness care is one of the huge unknowns in retired life, and a financial specialist can detail alternatives and suggest whether added insurance coverage as protection might be valuable. Prior to you begin, try to get comfy with the idea of sharing your whole financial image with a specialist.

Giving your professional a complete picture can help them develop a strategy that's focused on to all parts of your economic condition, especially as you're quick approaching your post-work years. If your funds are easy and you have a love for doing it yourself, you may be great on your own.

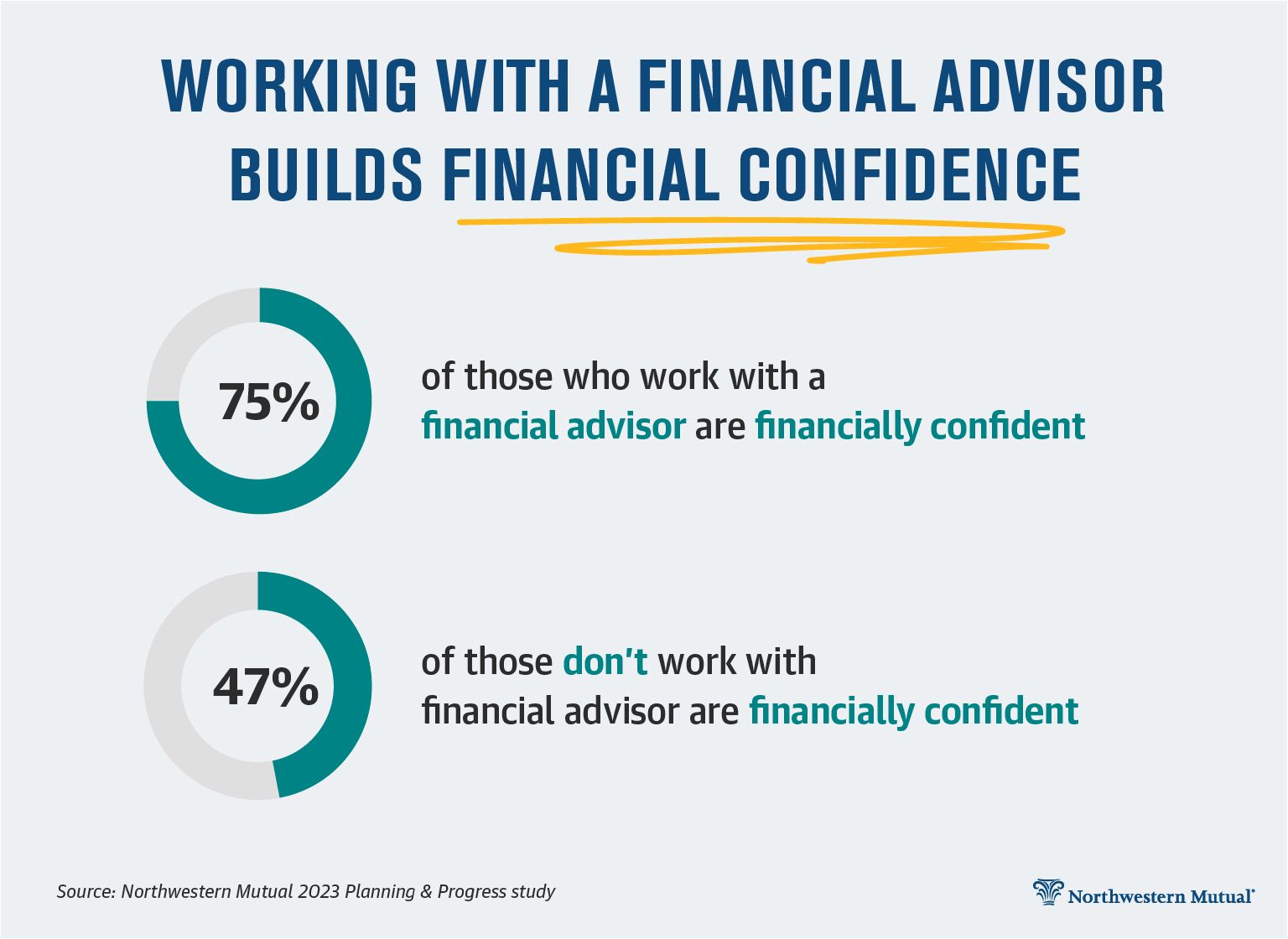

An economic consultant is not just for the super-rich; anybody encountering major life transitions, nearing retired life, or feeling bewildered by financial decisions might gain from specialist advice. This write-up checks out the duty of financial consultants, when you may need to get in touch with one, and essential considerations for picking - https://www.reddit.com/user/clrkwlthprtnr/. An economic expert is an experienced specialist that helps clients manage their finances and make educated choices that align with their life goals

Unknown Facts About Clark Wealth Partners

In comparison, commission-based advisors make income with the economic items they market, which may influence their suggestions. Whether it is marital relationship, separation, the birth of a youngster, job changes, or the loss of a loved one, these events have one-of-a-kind financial implications, frequently needing timely choices that can have long-term results.